am i taxed on stock dividends

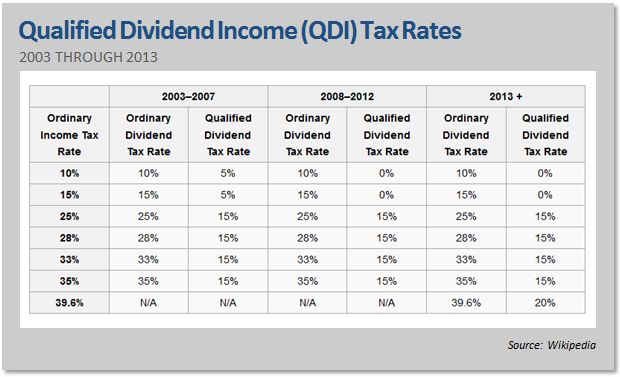

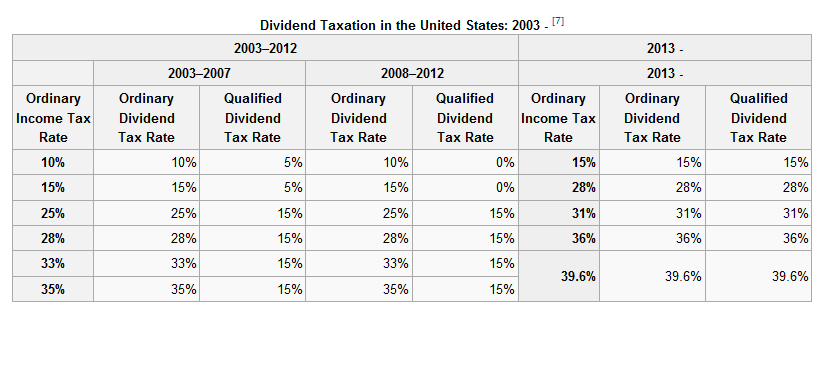

If you are in the 35 tax bracket a qualified dividend is going to be taxed at 15. The benefit of retirement accounts is that your money grows tax-free until retirement.

Special Dividend Definition Rules And Impact On Stock Price Intelligent Income By Simply Safe Dividends

Tax rate on dividends over the allowance.

. This is usually lower than the rate for nonqualified dividends. Visit our Dividend Calendar. Dividend Tax Rates for the 2022 Tax Year.

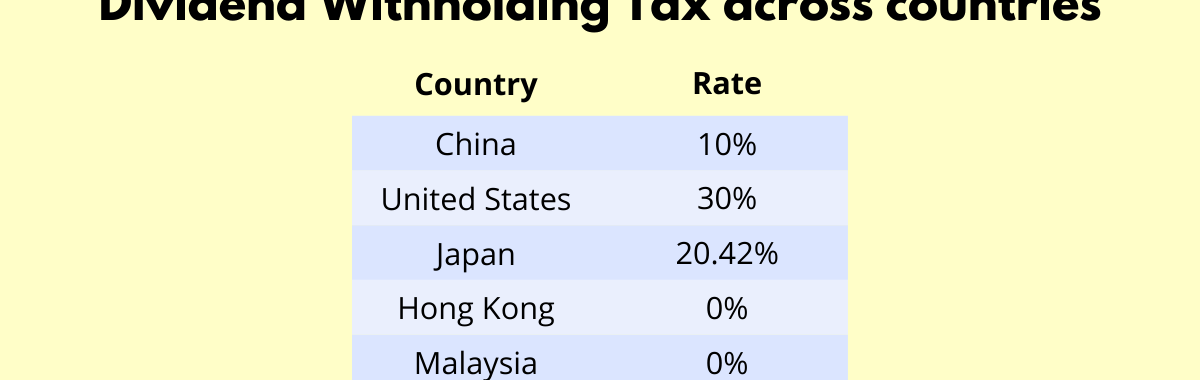

However thanks to 15 withholding tax it looks. If a stock pays dividends you generally must pay taxes on the dividends as you receive them. Learn ways dividends can help generate income in this free retirement investment guide.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. You generally pay taxes on stock gains in value when you sell the stock. The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account.

Unqualified dividends are taxed at your ordinary income tax rate the same rate that applies to your wages or self-employment income. 40001 for those filing single or married filing separately. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period.

The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements.

Discover the Power of thinkorswim Today. Ad Have a 500000 portfolio. Download The Definitive Guide to Retirement Income.

Long-term rates are lower with a cap of 20 percent in 2019. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. If your income is lower than 39375 or 78750 for married couples youll pay zero in capital gains taxes.

Currently they pay 052 per share per quarter equating to 5824 or 4215 at the current exchange rate. Our Suite of Platforms isnt Just Made For the Trading Obsessed - its Made by Them. But if it is an ordinary dividend it will be treated as ordinary income which means the tax hit is.

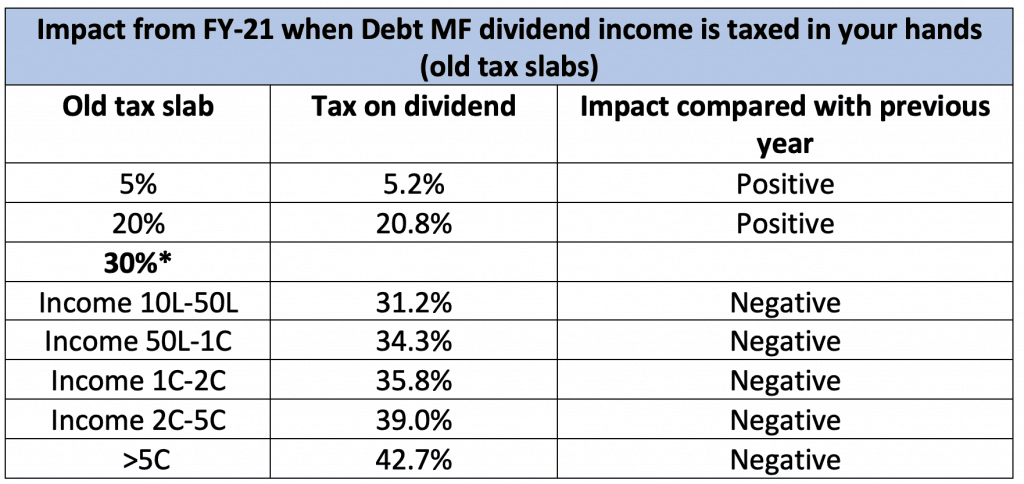

2 days agoTesla TSLA announces a 3-for-1 stock split with a stock dividend effective on Aug 25. My current thoughts are to move over a couple of the bigger US dividend-paying stocks to the SIPP such as ATT. Ordinary dividends are taxed using the ordinary income t ax brackets for tax year 2021.

Qualified dividend taxes are usually calculated using the capital gains tax rates. Qualified dividends are taxed at long-term capital gains rates. And if your income is 434551 or more your capital gains tax rate is 20.

To work out your tax band add. So if you fall into the 32 tax bracket youll pay a 32. The next step down at a 15 rate is anyone who records 78751 to 488850 in taxable income.

Back to AM Overview. As an example I currently have 112 shares of ATT ticker symbol T. Example Of No Withholding Tax.

In both cases people in. If your income is between 39376 to 434550 youll pay 15 percent in capital gains taxes. If you hold stock securities.

Qualified dividends come from investments in US. It will make the stock accessible to retail investors and might buoy its share price. You still need to pay taxes either before or after you contribute the money but you will not have to pay.

Nyse Nasdaq Amex Otcbb Dividend Tracker. Non-qualified or ordinary dividends which include most dividends paid to shareholders are taxed at short-term capital gains.

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

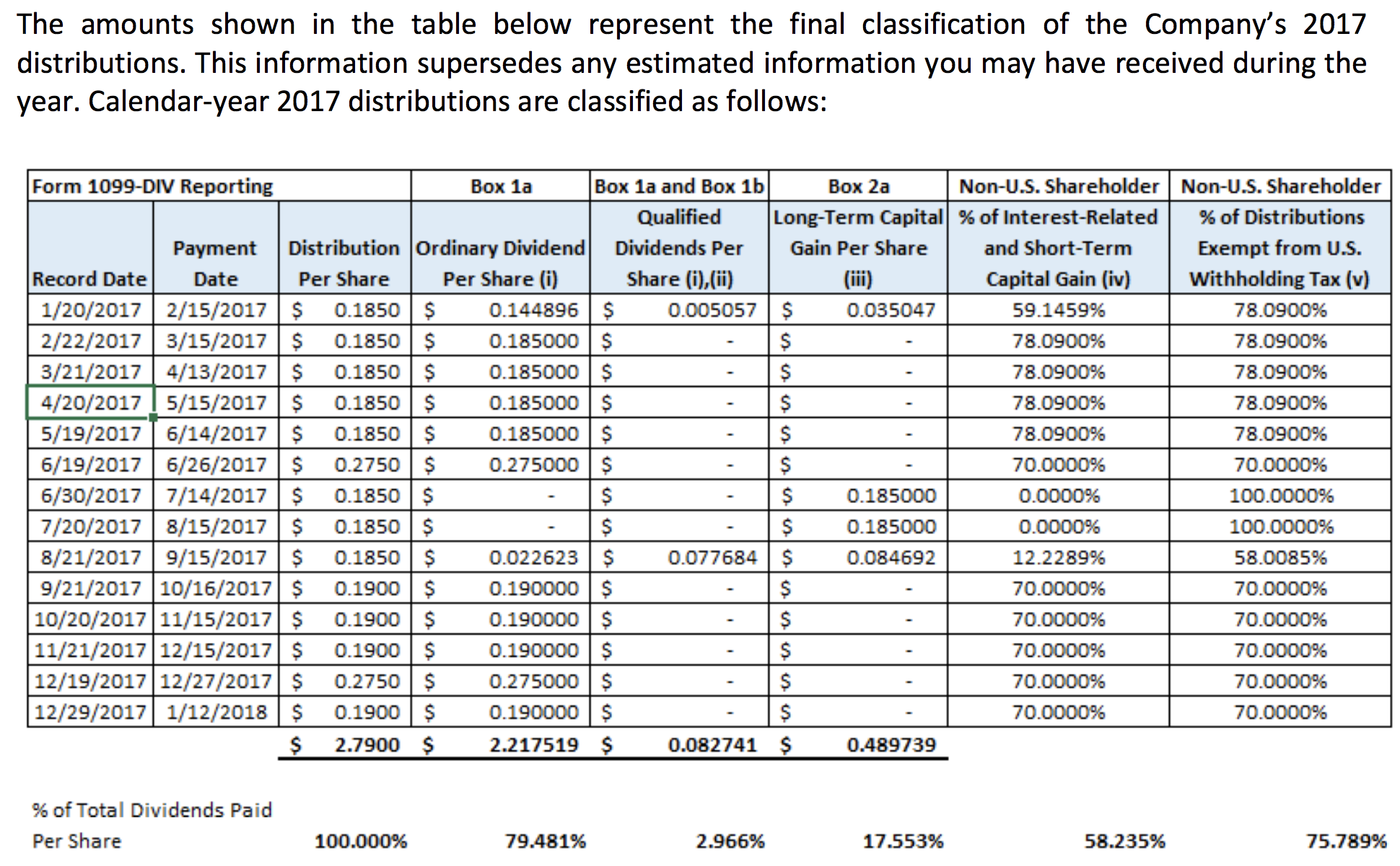

Form 1099 Div Dividends And Distributions Definition

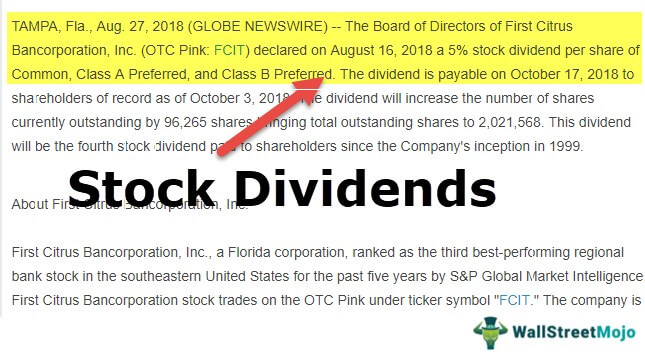

Stock Dividend Meaning Payout Calculation Journal Entry

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The 60 Day Qualified Dividend Rule White Coat Investor

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

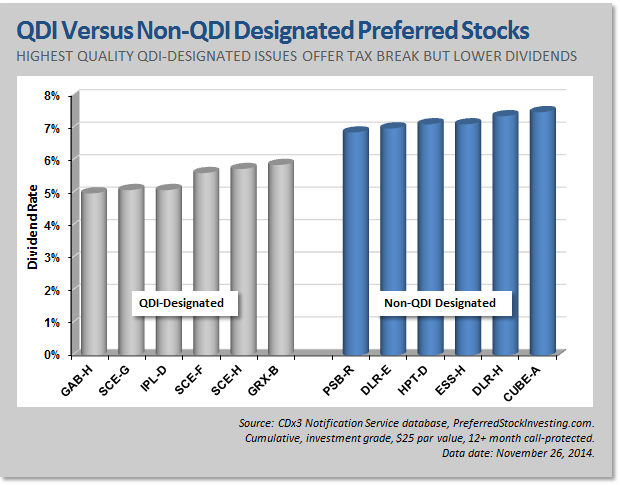

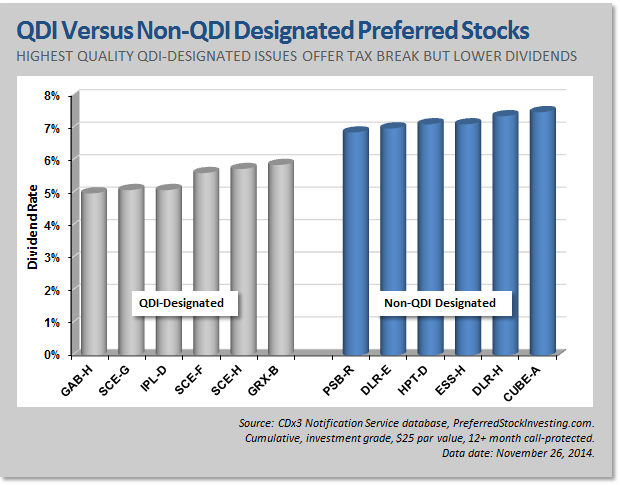

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

Selling Shares Beats Collecting Dividends Physician On Fire

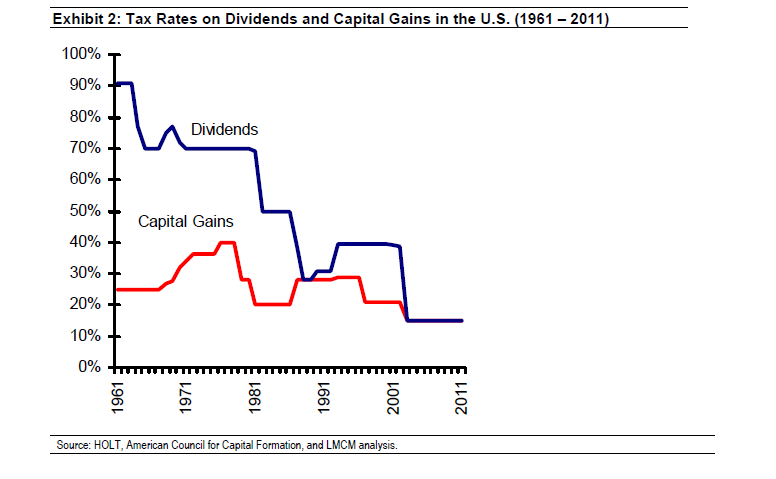

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Pay No Tax On Your Dividend Income Retire By 40

What You Need To Know About Capital Gains Tax

U S Dividend Withholding Tax What Singapore Investors Must Know

No Ddt The Impact On Your Dividend Income Primeinvestor

Tax Implications Of A Dividend H R Block

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)